You probably feel overwhelmed just thinking about budgeting money and how to create a budget.

It does not have to be daunting if you are getting it done little by little.

Let’s go and create a simple budget that you can stick to.

KNOW YOUR NUMBERS

How much are your monthly income and expenses? Get those numbers first. We need it to make our budget realistic.

You can use a notebook to write this down. Or if you have my Budget Planner You can simply fill out the Income and Expense tracker. (Picture above).

It is challenging the first month because this is when you are going to get your numbers.

As you can see, there are boxes for budgeted, actual, and the difference for your income and expenses.

We always create a budget for the following month. Let's say, we are creating a budget for the month of January. (pretending we are in December).

First, write down the projected or budgeted total income amount for January.

Second, we are going to budget an amount for our expenses. I guess you already have a calculated amount from the past.

Third, we need to get the difference between the budgeted and the actual. This is where the hard work comes in.

THE GOAL HERE is to determine if you are spending beyond or within your limits and get the total income and expenses for a month.

Every money you spend should be listed down. Either credit or cash. You have to write down every payment and purchase you make.

Use a separate notepad to write down all your expenses. No exceptions.

My Budget Planner has expense tracking categories, track the money printables, and budget worksheets so it is easier for you to categorize and track your expenses.

After the first month, you should understand your finances, how much you make, and where your money is going.

You can now make adjustments to your budget for the following months.

If your expenses are higher than your income, adjust your variable expenses like food, travel, and shopping.

MAKE FINANCIAL PLANS

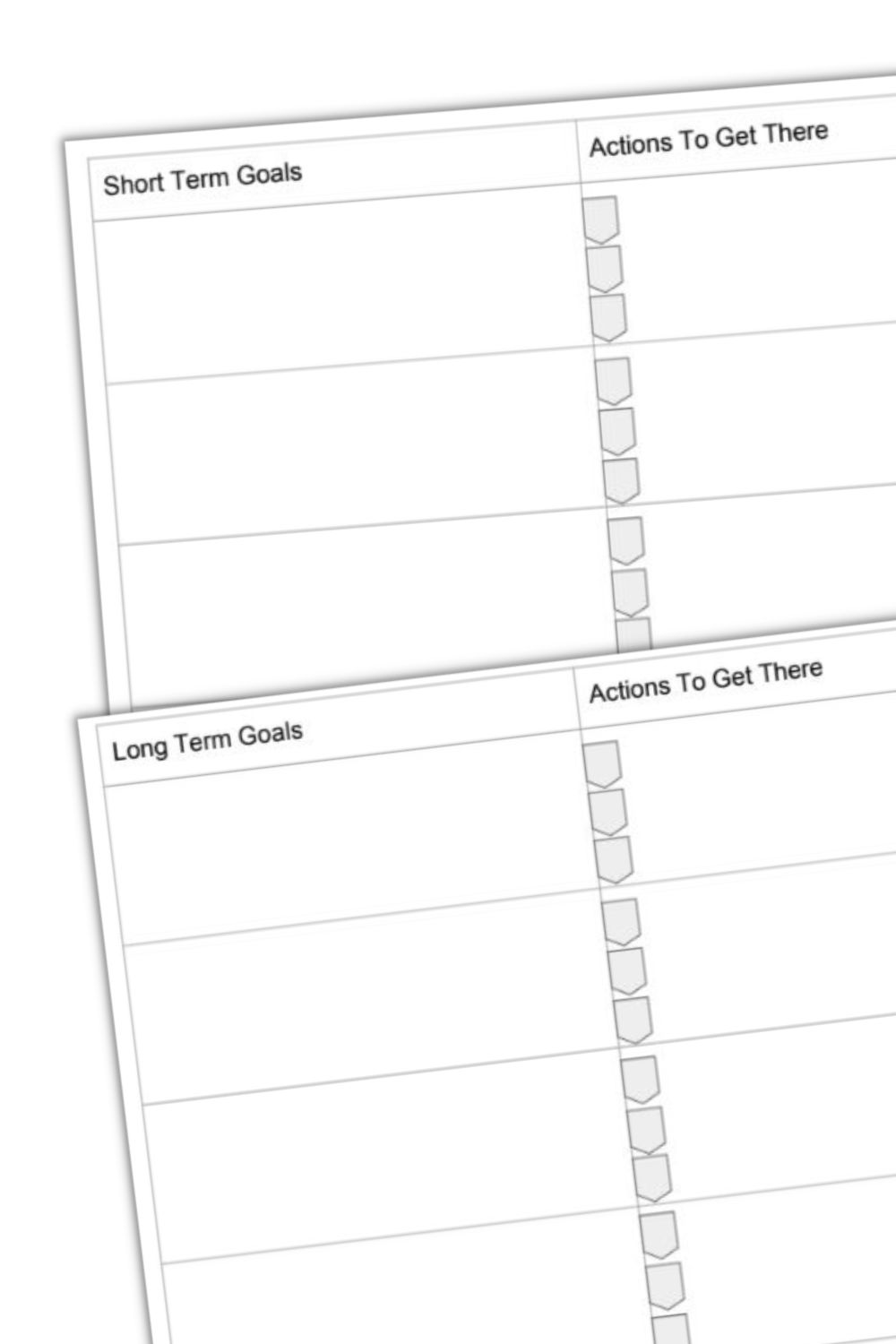

Now that you have a better grasp of your finances, you are ready to set financial goals. Short and long-term.

Save up for emergencies like hospital bills and loss of job. It is better to be prepared for times like this.

ADJUST YOUR BUDGET AS NEEDED

It is important to set a realistic budget especially if there are some recent changes in your life.

If you are using printables, you don't have to buy planners every year because they are updated and you can print as many as you like.

You might also want to check out this Budget Planner below.

Take a look at all the planners you can grab for a tiny price. You'll get everything you need to manage your home, meal planning, budgeting, chores, self-care, and more.

Save it on Pinterest, please.

Disclosure: The contents published in this blog may have affiliate links. We might get an affiliate commission at no extra cost to you when you buy from this site. Please be informed that I only recommend products and services that will bring value to you.

.jpg)

.jpg)

%20(1).jpg)

.jpg)

.jpg)

%20(1).jpg)

0 Comments:

Post a Comment